Danske Bank Money Laundering Explained

The concept of cash laundering is essential to be understood for those working in the monetary sector. It is a process by which dirty money is converted into clean money. The sources of the cash in precise are prison and the cash is invested in a way that makes it seem like clear money and conceal the identity of the criminal part of the cash earned.

While executing the financial transactions and establishing relationship with the new prospects or maintaining current clients the responsibility of adopting sufficient measures lie on each one who is part of the group. The identification of such ingredient in the beginning is straightforward to take care of as a substitute realizing and encountering such conditions later on within the transaction stage. The central financial institution in any country supplies complete guides to AML and CFT to fight such activities. These polices when adopted and exercised by banks religiously provide sufficient safety to the banks to deter such situations.

Each day we do what we can to make it as difficult as possible to use Danske Bank for financial crime including money laundering and it has never been harder than it is today. On Wednesday Estonian prosecutors detained 10 former employees of Danske Bank on suspicion of knowingly enabling money laundering and threatened that more arrests were likely over the largest.

Danske Bank Money Laundering Is Europe S Biggest Scandal News Dw 20 09 2018

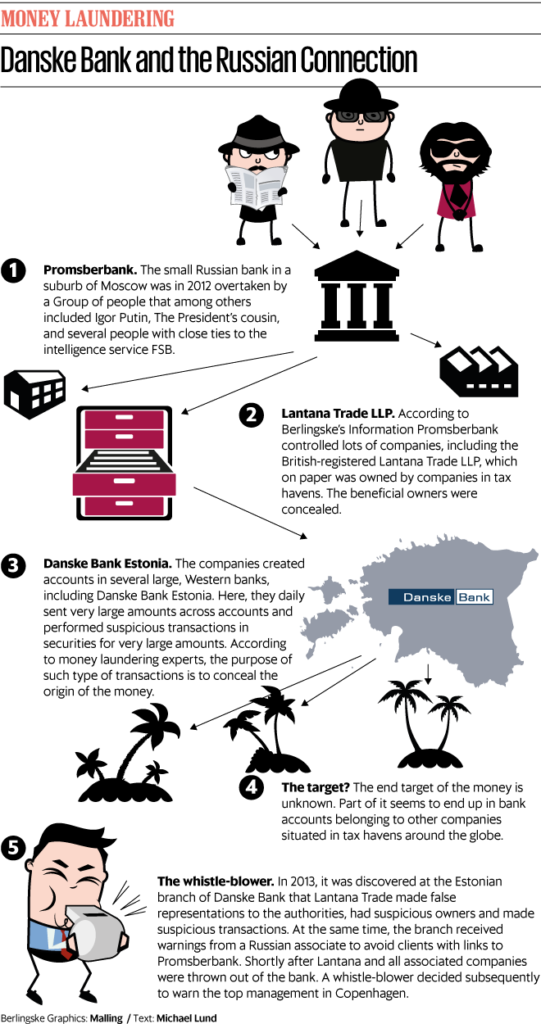

It began in 2007 following the acquisition from Danske Bank of Finnish Sampo Bank which also had an Estonian branch.

Danske bank money laundering explained. Massive Danske Bank Money Laundering Scandal Continues to Unfold. Danske Bank Denmarks largest lender has found itself at the centre of one of the worlds biggest money-laundering scandals. CEO Thomas Borgen has given the following written response.

The Danske Bank money laundering scandal continues to reveal its many permutations and confirm its status. Large US bank 2 was a Danske correspondent bank from 2013 until it ended that relationship in 2015. So said Thomas Borgen CEO of Denmarks biggest financial institution when he resigned after admitting that around 200 billion of questionable money flowed through the Danish banks Estonian branch from 2007-15.

Facebook0Tweet0LinkedIn0 It is clear that Danske Bank has failed to live up to its responsibility in the case of possible money laundering in Estonia. Danske Bank has previously stated that its top management in Copenhagen was alerted to the money laundering problems in Estonia by a whistleblower but the bank has consistently refused to publish any further details concerning these warnings. Danske Bank is far from the only offender here.

Danske Bank was organized in 1871 and has continuously operated since then. Howard Wilkinson the whistleblower who. Monday March 4 2019.

The investigations have been led by the Bruun Hjejle law firm and their Report on the Non-Resident Portfolio at Danske Banks Estonian branch is enclosed with this press release. However according to Wilkinson the vast majority of the laundered funds at issue approximately 150 billion flowed through European Bank 1 which was a Danske correspondent bank until 2015. Danske Bank has previously concluded that it was not sufficiently effective in preventing the branch in Estonia from being used for money laundering in the period from 2007 to 2015.

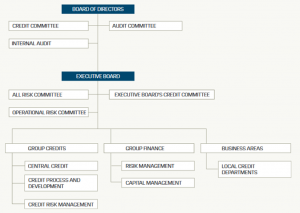

Danske Bank money laundering scandal is one of the largest money laundering scandal in European history. Large regulatory bodies as well as individual customers of the bank have questioned how much of the issue was excusable misunderstanding between the branch and Executive Board of the bank and how. There are outstanding money laundering or transaction laundering cases open against numerous banks.

The scandal surrounding Danske Bank is the most significant recent instance of money laundering with 236 billion in laundered money estimated to have passed through its Estonian branch. Reuters - Danske Bank DANSKECO is embroiled in a money laundering scandal that has triggered criminal investigations forced out its CEO and chairman and rattled investors in Denmarks. Danske Bank has run into trouble resulting from alleged money laundering in its Estonian branch.

The Danske Bank money laundering scandal arose in 2017-2018 when it became known that around 200 billion of suspicious transactions had flowed from Estonian Russian Latvian and other sources through the Estonia-based bank branch of Denmark-based Danske Bank from 2007 to 2015. It is a key priority for us to strengthen and improve our efforts on an ongoing basis and cooperate closely with authorities and others to achieve as strong a defence as possible against the criminal networks. Its board and management now face the daunting task of dealing with the Banks current difficulties.

It has been described as possibly the largest money laundering scandal ever in Europe and as possibly the. Morgan was the first to suspect that Danske Bank was laundering large amounts of Russian money through its Estonian branch and it broke off its banking relationship in 2013. It is clear that Danske Bank has failed to live up to its responsibility in the case of possible money laundering in Estonia.

So said Thomas Borgen CEO of Denmarks biggest financial institution. Explaining Danske Banks 200 Billion Money Laundering Scandal. Danske Bank has been caught up in one of the largest-ever money laundering scandals.

Where these funds wound up is anyones guess.

Http Www Europarl Europa Eu Cmsdata 150740 Tax3 2026 20april 202018 Verbatim 20report En Pdf

Danske Bank Money Laundering Case Study The Finreg Blog

Danske Bank Europe S Largest Money Laundering Scandal Youtube

Danske Bank Scandal Where Did The Money Flow Compliance Matters

Danske Anatomy Of A Money Laundering Scandal Financial Times

Danske Anatomy Of A Money Laundering Scandal Financial Times

Danske Bank Money Laundering Is Europe S Biggest Scandal News Dw 20 09 2018

Danske Anatomy Of A Money Laundering Scandal Financial Times

Danske Bank Money Laundering Case Study The Finreg Blog

Money Laundering At Danske Bank 360storybank

Howard Wilkinson And Stephen Kohn Testimony At European Parliament Money Laundering Scandal Youtube

Danske Bank Money Laundering Case Study The Finreg Blog

Danske Bank Money Laundering Is Europe S Biggest Scandal News Dw 20 09 2018

The world of rules can appear to be a bowl of alphabet soup at times. US cash laundering rules are not any exception. We now have compiled an inventory of the highest ten cash laundering acronyms and their definitions. TMP Danger is consulting firm focused on defending monetary services by lowering risk, fraud and losses. We have huge bank expertise in operational and regulatory threat. We now have a powerful background in program administration, regulatory and operational danger as well as Lean Six Sigma and Business Process Outsourcing.

Thus cash laundering brings many antagonistic penalties to the organization due to the risks it presents. It increases the likelihood of main dangers and the chance value of the financial institution and in the end causes the financial institution to face losses.

Komentar

Posting Komentar